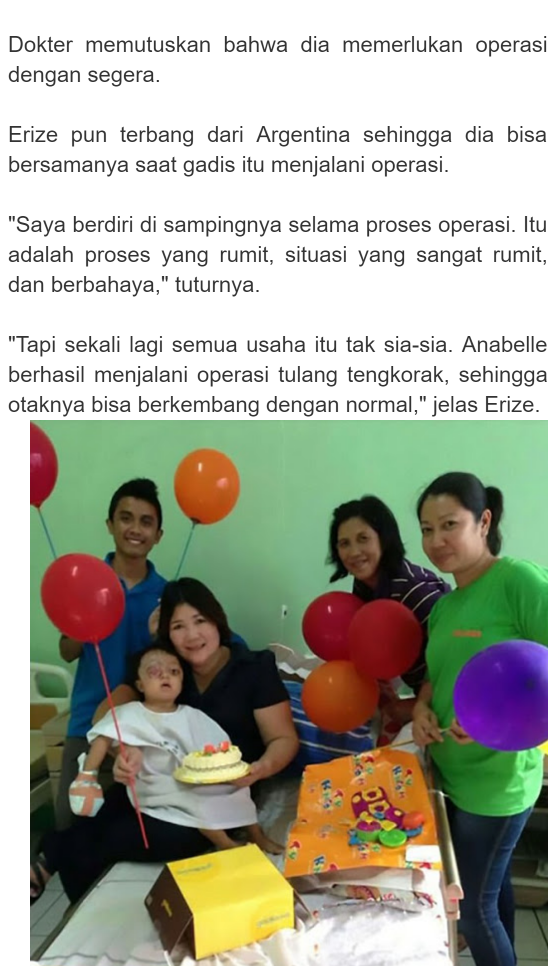

7 Best Small Business Credit Cards (Cash Back, Bad Credit, More) From cups and coffee to staplers and sticky notes, running a business requires a lot of supplies — and expenses. One of the best ways to manage your daily expenditures is by using a business credit card for your purchases. Not only does a business card ensure you won’t be dependent on having cash on hand to make important purchases (which can be a problem when you’re waiting for invoices to get paid), but online issuer portals and mobile apps can be a good way to keep track of your spending. Of course, as with personal credit cards, one of the best parts of a great business credit card is the rewards. Whether you want cash back, airline miles, or flexible rewards points, you can likely find a business card to suit you — and your business. Top Cash Back Cards for Small Business The most straightforward of rewards types, getting cash back for your purchases is like having a discount coupon that applies to just about everything. When it comes to cash back cards, the Capital One Spark Cash card is certainly a strong contender. It has one of the best general cash back bonus levels, offering an unlimited 2% cash back on all of your purchases so you don’t have to keep track of bonus categories. The Spark Cash card also comes with a generous cash back bonus once you hit the initial spending requirements. 1. Capital One® Spark® Cash for Business You can also add employee cards to your Spark Cash account — at no additional charge — and earn the same cash back rewards from employee purchases. For those who don’t spend quite as much, the Capital One Spark Cash Select card has a lower spending requirement to receive the decent cash back bonus. You’ll also earn an unlimited 1.5% cash back on all of your purchases. The best part? No annual fee. 2. Ink Business Cash℠ Credit Card If your business expenses involve a lot of car trips to the office supply store, the Ink Business Cash card may be for you. In addition to cash back at office supply stores, you can also earn bonus rewards on gas and dining. You won’t pay any annual fee for your Ink Business Cash card, and your cash back rewards won’t expire as long as your account remains open. The online application takes just minutes to complete. 3. Capital One® Spark® Cash Select for Business Your Spark Cash Select card also has no minimum requirements for redeeming your cash back, so you can get your money on your terms 4. SimplyCash® Plus Business Credit Card While the SimplyCash Plus Business card does not offer a signup bonus, it does have good cash back rewards that you can customize around your business needs. Additionally, the SimplyCash Plus card has no annual fee to undercut the value of your cash back rewards. 5. Cash Rewards for Business The Cash Rewards for Business credit card from Bank of America is a solid business card, offering a good signup bonus with one of the lowest spending requirements on the market. The online application takes just minutes to fill out, and you can redeem your cash back rewards as a statement credit or deposit to your Bank of America business checking or savings account. 6. Business Platinum Card® For businesses with a higher volume of spending, the Business Platinum card from American Express is a great option. You can earn 50,000 bonus points after spending $10,000 in the first 90 days, and an extra 25,000 bonus points if you spend another $10,000 in those same 90 days. 7. Business Gold Rewards Card Offering a more easily attainable spending requirement for a still-meaty signup bonus, the Business Gold Rewards card from American Express is a good alternative if your business doesn’t spend enough to make the Platinum card worthwhile. Whether you’re a CFO or one-man show, a good business credit card is a must-have — especially when it can help you earn miles or points toward free travel and rewards on every stapler and coffee cup. With so many options on the market, choosing the right business card will likely come down to choosing the best rewards for your business style and spending habits, so make sure to compare your options before making a selection.